In terms of Customer Value Management, there are two techniques that are essential: Recency, Frequency & Monetary value (RFM) analysis and Customer Lifetime Value. But what are they?

How do we use these tools? And how should we interpret these calculations? Keep reading for a clear and helpful overview.

Need help with your marketing strategy?

RFM analysis: Recency, Frequency & Monetary value

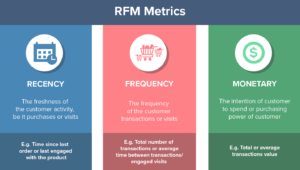

Let’s start by having a look at the fundamental elements of customer value: Recency, Frequency and Monetary value (RFM).

RFM is a marketing analysis technique used to organise your customers from least valuable to most valuable, by taking into account how recently a customer has purchased (Recency), how often a customer makes a purchase (Frequency) and how much a customer spends (Monetary value).

When you evaluate your customers based on these metrics, your company can make well-founded predictions about which customers are most likely to make high-value purchases again in the future.

As well as being built on these three data points, RFM analysis is also based on the Pareto Principle that 80% of your business comes from 20% of your customers. By using the RFM metrics, you’ll be able to see if the Pareto Principle applies to your company (which is very likely).

Calculating RFM

The first step in the process involves collecting data on the RFM pillars:

– Recency (Most recent purchase date)

– Frequency (Number of purchases)

– Monetary value (Total sales from customer)

Next, create specific categories for each of the RFM pillars and assign numbers to those categories, by grading them from 1 to 5 for example.

When each customer is scored per category , you can calculate a total score per customer and rank your customers in order of importance. The exact categories will depend on your type of business and other factors. Here’s an example:

Example:

| 1 | 2 | 3 | 4 | 5 | |

| Recency | 6+ months | Quarter | Month | Week | Day |

| Frequency | 1-2 purchases | 3-5 purchases | 6-8 purchases | 9-10 purchases | 10+ purchases |

| Monetary | € 0 – € 49 | € 50 – €149 | € 150 – € 249 | € 250 – € 499 | € 500+ |

Customer X has a total sales value of €250, spread over 4 purchases and his last purchase was 1 week ago.

Calculation

– Recency: 1 week ago => 4

– Frequency: 4 purchases => 2

– Monetary value: € 250 => 4

Customer X receives a score of 4-2-4 → 424.

Note: This scoring system has 125 possible scores and the higher the score, the more valuable the customer.

RFM Segmentation

With RFM segmentation you can target specific groups of customers, divide them into segments and integrate the scores given to your customers.

As you can see in the table below, you can identify the characteristics of each segment, and the necessary marketing actions to improve the relationship with customers in that segment

Why an RFM analysis makes sense

RFM analysis is a customer segmentation technique that evaluates which customers are most and least valuable to a company, based on recency, frequency and monetary value.

The next step is to link a description and marketing actions to each segment to improve your relationship with all the customers within the clusters.

For the best results, you should also use additional insights from customer feedback and previous marketing data to help you decide the best way to communicate with your customers.

By segmenting your customers with RFM, you can also each group individually and determine which set of customers has the highest Customer Lifetime Value (CLV), as we will explain further.

What is Customer Lifetime Value?

Customer Lifetime Value (CLV) represents the average amount of money a customer is expected to spend on a specific organisation or brand over their entire lifetime.

The number shows how much your customers like your products or services, what you’re doing right in terms of your relationship with your customers as well as how you can improve.

Calculating this metric helps every business owner decide how much money they should invest in acquiring new customers and retaining existing ones.

How to calculate customer lifetime value?

To calculate your CLV, you first need to know the lifetime value:

Lifetime value = average value of sales x number of transactions x retention time period

Keep in mind that the (customer) lifetime value is a financial projection: you need to make assumptions and estimate the value of average sales, numbers of transactions and the average length of the customer relationship.

The next step is to take your operating expenses into consideration:

Customer lifetime value = lifetime value x profit margin

By calculating the customer lifetime value, you can answer questions like:

- What are our most profitable customer types?

- Which products have the highest profitability?

- Which products do our most profitable customers want?

Example

- Average value of sales: €1,000

- Average customer lifetime: 3 years

- Number of transactions per year: 5

- Profit margin per customer: 10%

Calculation

€1,000 (average value of sales) x 5 (number of transactions) x 3 (retention time period) = €15,000

€15,000 (lifetime value) x 10% (profit margin) = € 1,500

Customer lifetime value = € 1,500

By combining the segments that that your RFM analysis revealed, you can add the customer lifetime value to see which of your customers perform best.

Boosting your Customer Lifetime Value

Now that it’s clear what CLV is and how it should be calculated, it’s time for the next step in the process: boosting the customer lifetime value.

Here are some examples:

- Offer a loyalty program to encourage repeat purchases.

- Create an ‘underpromise and overdeliver’ policy – a strategy where service providers strive for excellent customer service and satisfaction by doing more than they say they will for the customer or exceeding customer expectations.

- Stay in touch with your customers through check-in mails and/or thank-you mails.

- Send coupon codes and other special offers.

- Make use of funnel traffic from social media and create additional brand awareness.

Conclusion

Customer Lifetime Value matters more than most businesses think. The results of this analysis will help you in the long run, and you should grab this opportunity to start calculating and improving your CLV.

Implement strategies to increase your customer lifetime value, invest in retaining customers and acquiring new ones and you will be ready for future growth.

For more information about customer lifetime and rfm analysis, take a look at our customer value management guide.

Confused about all these calculations? Let us help you!